Life insurance height weight chart is a crucial aspect of determining insurance premiums. It provides a historical overview of how insurers have used physical attributes to assess risk. However, these charts have limitations and biases, and modern risk assessment methods are evolving.

This article delves into the details of life insurance height weight charts, exploring the data behind them, their impact on premiums, alternative assessment methods, and the potential role of technology in shaping the future of risk evaluation. Understanding these nuances is key to making informed decisions about life insurance policies.

Introduction to Life Insurance Height Weight Charts

Life insurance, a crucial aspect of financial planning, often involves assessing risk to determine premiums. Historically, insurers relied on various factors to gauge risk, and height and weight charts were a prominent tool. While their use has evolved, understanding their role in the past and present is key to grasping the intricacies of life insurance.Height and weight charts were originally used to predict mortality risk.

The logic behind this was simple: certain physical attributes might correlate with health conditions that could lead to premature death. These correlations were often based on statistical analysis of large populations, attempting to identify trends between physical characteristics and longevity.

Historical Context and Purpose

Early life insurance companies used height and weight charts to categorize individuals into risk groups. This facilitated the creation of premium structures, with those deemed higher risk paying higher premiums. The purpose was straightforward: to assess risk and price policies accordingly. These charts were intended to streamline the underwriting process, enabling quicker and more efficient evaluation of applicants.

Limitations and Potential Biases

Height and weight charts, while once useful, are not a perfect predictor of health. Significant limitations include the fact that they don’t account for individual lifestyle factors, such as diet, exercise, and smoking habits. A person with a higher BMI might be incredibly active and healthy, while someone with a lower BMI might have underlying health issues. This lack of individualization can lead to significant inaccuracies.Furthermore, these charts often exhibit inherent biases.

For instance, they might not accurately reflect the health status of individuals from diverse backgrounds or ethnicities. The historical data used to create these charts could be influenced by societal factors that disproportionately affect certain populations.

While life insurance height weight charts seem simplistic, their inherent biases often overshadow their purported accuracy. They frequently fail to account for individual health factors, making them a questionable metric for assessing risk. This is strikingly similar to the inherent assumptions baked into many recipes, like a recipe for apple pie using canned apple pie filling recipe for apple pie using canned apple pie filling , which can drastically alter the final outcome depending on the quality of the ingredients.

Ultimately, both require a more nuanced approach to truly understand the complexities involved.

Usage in Underwriting

Insurance underwriters use height and weight information as one component of a broader evaluation. While not the sole determinant, it’s a factor that’s still considered alongside other criteria like medical history, family history, and lifestyle choices. This comprehensive approach aims to provide a more nuanced assessment of risk.

Types of Life Insurance and Premium Impact

Different types of life insurance policies react differently to height and weight considerations. Term life insurance, designed for a specific period, might have slightly different premium structures based on risk factors. Permanent life insurance, such as whole life or universal life, also factors in height and weight, though potentially less directly, as they are designed for long-term coverage.

- Term Life Insurance: Premiums for term life insurance are often directly correlated to perceived risk, influenced by factors like age, height, weight, and health. Higher risk applicants will typically pay higher premiums.

- Permanent Life Insurance: For permanent life insurance, height and weight may play a smaller role compared to term life insurance. Underwriting is more comprehensive, considering a range of factors beyond physical attributes. However, the initial premium amount might still be impacted by perceived risk.

Modern Trends and Considerations, Life insurance height weight chart

Modern insurance companies increasingly rely on sophisticated actuarial models that go beyond simple height and weight charts. These models integrate a broader range of health factors, including genetic predispositions and blood markers, to provide a more accurate and personalized risk assessment. The goal is to provide a more accurate evaluation of an applicant’s long-term health risks, rather than relying on simplified metrics.

Understanding the Data Behind the Charts

Life insurance height and weight charts are more than just arbitrary numbers. They represent years of painstaking research and data analysis, aiming to predict mortality risk. Understanding the factors that go into these charts is key to appreciating their limitations and potential biases, as well as recognizing their role in pricing policies.These charts are built on a foundation of statistical models, correlating physical attributes like height and weight with the likelihood of death at various ages.

This is not a perfect science, and it’s important to be aware of the methodologies and the factors that affect the accuracy of these estimations.

Data Collection and Compilation Methods

Life insurance companies rely on vast datasets to create these charts. These datasets are often compiled from multiple sources, including existing insurance records, epidemiological studies, and government health surveys. This comprehensive approach aims to capture a representative sample of the population. The sheer volume of data is critical in smoothing out individual anomalies and identifying patterns that are not immediately apparent in smaller datasets.

Factors Considered in Determining Mortality Rates

Mortality rates aren’t simply determined by height and weight. A multitude of factors influence the risk of death. Age is the most crucial factor. Underlying health conditions, smoking habits, family history of diseases, and lifestyle choices also play a significant role. These are often incorporated into more sophisticated models beyond simple height and weight correlations.

Impact of Medical Advancements and Changing Demographics

Medical advancements significantly impact mortality rates. Improvements in treatments and preventive measures have altered the relationship between physical attributes and lifespan. Changing demographics, such as increasing life expectancy and shifts in population distribution, also influence the data used to create these charts. This necessitates continuous updates to the charts, to reflect the evolving nature of health and society.

For example, the increased prevalence of certain diseases or the rising rates of obesity would need to be reflected in the updated charts.

Correlating Height, Weight, and Mortality Risk

The correlation between height, weight, and mortality risk is complex. Different models are employed, some simpler than others, to establish relationships between these factors. The most straightforward method might use a statistical model that establishes a relationship between body mass index (BMI) and mortality risk. However, more advanced techniques may account for various factors and provide more nuanced predictions.

Potential Inaccuracies and Biases in Data Collection and Analysis

Data collection and analysis are never perfect. There’s always a potential for inaccuracies and biases. One potential source of error is the accuracy of the data submitted by individuals. There may also be selection bias, as individuals who choose to purchase life insurance may have different characteristics compared to those who don’t. Furthermore, there might be biases embedded within the models used to analyze the data, leading to skewed results.

It is crucial to be aware of these limitations and to interpret the results cautiously.

Impact of Height and Weight on Premiums

Life insurance premiums aren’t a one-size-fits-all figure. Factors like your height and weight play a significant role in determining the cost. Insurance companies assess these factors to calculate the risk associated with insuring your life. Understanding how these factors influence premiums can help you make informed decisions about your policy.Insurance companies use actuarial data to estimate the likelihood of death at different ages.

This data, which considers various factors including height, weight, and medical history, allows them to calculate the appropriate premium for each individual. Height and weight are just two components in a complex calculation, but they are important ones, influencing the risk profile.

Premium Variations Based on Height and Weight

Insurance companies generally categorize individuals into different height and weight brackets to determine premiums. These categories are usually based on Body Mass Index (BMI) which is calculated by dividing weight in kilograms by the square of height in meters. This approach provides a standardized way to assess risk across a diverse population.

| Height (inches) | Weight (lbs) | BMI Category | Estimated Premium (sample policy – $100,000 coverage) |

|---|---|---|---|

| 60-64 | 120-150 | Underweight/Healthy Weight | $150/year |

| 65-69 | 150-180 | Healthy Weight | $175/year |

| 70-74 | 180-210 | Healthy Weight/Overweight | $200/year |

| 75-79 | 210-240 | Overweight | $225/year |

| 80+ | 240+ | Obese | $250+/year |

These figures are illustrative and should not be taken as precise estimates. Actual premiums will vary significantly depending on the insurance company, policy type, and other factors like age and health. This table demonstrates how a higher BMI, generally associated with increased health risks, correlates with higher premiums.

Adjustments in Premium Calculation

Insurance companies adjust premiums based on various factors, including height and weight. Factors such as age, gender, and lifestyle choices also play a significant role in calculating premiums. These calculations consider mortality tables, medical history, and other factors to predict the likelihood of death during the policy period.

The principle behind this approach is to balance the financial risk of the insurer with the cost of the policy for the insured.

For example, a 30-year-old male who is 6 feet tall and weighs 180 pounds will likely have a lower premium than a 60-year-old female who is 5 feet 4 inches tall and weighs 200 pounds. This is because the risk of death is generally lower for younger, healthier individuals.

Policy Type and Premium Impact

Different types of life insurance policies react differently to height and weight variations.

| Policy Type | Height/Weight Impact |

|---|---|

| Term Life Insurance | Premiums are generally more sensitive to height/weight variations, especially for higher risk categories. |

| Whole Life Insurance | Height/weight has a smaller impact compared to term life insurance. |

| Universal Life Insurance | Premiums can fluctuate depending on the policy’s specific provisions and the insured’s risk profile. |

These variations in premiums reflect the varying levels of risk associated with different policy types. Premiums for term life insurance, for instance, are more responsive to changes in health risks due to the limited duration of coverage. Premiums for whole life insurance tend to be less sensitive to these factors due to the longer duration and investment components.

Alternative Methods for Risk Assessment

Life insurance used to rely heavily on simple height and weight charts, but modern risk assessment is far more sophisticated. Gone are the days of crude estimations; insurers now employ a multifaceted approach that considers a wealth of information beyond just your physical dimensions. This more nuanced strategy allows for a more accurate evaluation of your risk profile, leading to fairer premiums and more tailored policies.Modern life insurance companies use a combination of factors to determine the likelihood of someone experiencing a health event.

Instead of relying solely on static measurements, they incorporate dynamic data reflecting a person’s current health state and lifestyle choices. This allows for a more comprehensive and personalized approach to risk assessment.

Medical History

Medical history is a cornerstone of modern risk assessment. Insurers meticulously examine past illnesses, surgeries, and any chronic conditions. This includes diagnoses, treatment plans, and recovery times. A history of conditions like diabetes, heart disease, or cancer significantly impacts the risk assessment. A thorough medical history allows insurers to better understand an individual’s health trajectory and predict future health needs.

Lifestyle Factors

Beyond medical history, insurers also consider lifestyle factors. Smoking habits, alcohol consumption, and diet are all evaluated. Exercise routines and overall activity levels are also considered, as these play a pivotal role in maintaining good health. These factors are crucial because they provide insight into an individual’s commitment to their well-being and the proactive steps they take to mitigate health risks.

Health Metrics and Questionnaires

Insurers employ various health metrics to refine risk assessment. Blood pressure, cholesterol levels, and blood glucose readings, if available, offer valuable insights. Furthermore, comprehensive health questionnaires are employed to gather detailed information on lifestyle, health habits, and family medical history. These questionnaires are designed to gauge risk factors in a systematic way, providing a more granular view of an individual’s overall health.

While life insurance height weight charts often seem simplistic, their inherent limitations are readily apparent. These charts, frequently used to establish preliminary risk assessments, are often overly generalized, failing to account for individual health conditions. This can lead to inaccurate premium calculations, especially when considering properties like lifestyle choices and family history. For instance, someone living at 131 Lonsdale st Melbourne vic 3000, with a known predisposition to certain health risks, might face significantly different premiums compared to an individual with similar metrics but a healthier profile.

Ultimately, a nuanced approach to assessing risk, incorporating a wider range of factors, is crucial for fair and accurate life insurance pricing.

Examples of Health Questionnaires

Health questionnaires are crucial tools in underwriting. These detailed forms delve into various aspects of an applicant’s health. They often inquire about past illnesses, surgeries, medications, and family history of certain diseases. Examples of questions might include: “Have you ever been diagnosed with a chronic illness?” or “Do you regularly engage in strenuous physical activity?”. Such questions enable a more holistic view of the applicant’s risk profile, going beyond basic measurements to encompass a wider spectrum of factors.

Comparison with Traditional Height/Weight Charts

Traditional height/weight charts are relatively simple and inexpensive. However, they offer a limited view of an individual’s overall health. Modern methods, encompassing medical history, lifestyle factors, and health metrics, provide a significantly more comprehensive and accurate assessment of risk. This advanced approach acknowledges that a person’s health is far more complex than simply their height and weight.

Importance of Complete Medical Evaluation

A complete medical evaluation is essential for accurate insurability determination. This involves a thorough review of medical records, consultation with medical professionals, and possibly physical examinations. This multifaceted approach ensures that the insurance company has a complete picture of the applicant’s health status. Without a comprehensive evaluation, the insurer might miss crucial information, potentially leading to inaccurate risk assessment and inappropriate premium pricing.

Illustrative Examples of Height Weight Charts

Life insurance companies use height and weight data to assess risk and determine premiums. This information is part of a complex model, considering various factors. The charts are simplified representations of a much broader risk assessment process.

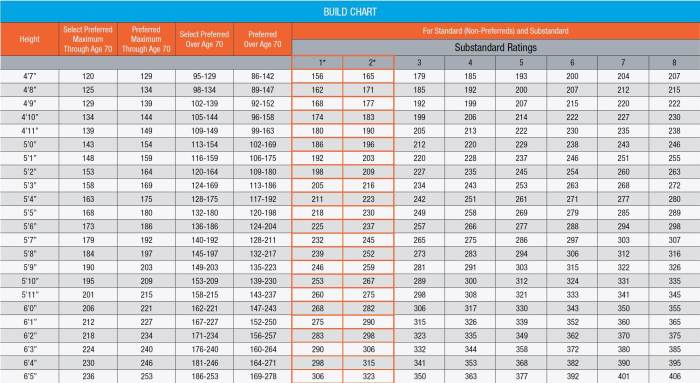

Sample Life Insurance Height Weight Chart (Age 30-35)

Insurance companies categorize individuals based on height and weight to group similar risk profiles. This simplification helps in pricing policies. The chart below shows a hypothetical example for individuals aged 30-35. Note that actual charts used by insurers are significantly more detailed and include a wide range of factors beyond height and weight.

| Height (inches) | Weight (lbs) | Premium Category |

|---|---|---|

| 5’4″ – 5’6″ | 120-150 | Standard |

| 5’4″ – 5’6″ | 151-170 | Preferred |

| 5’4″ – 5’6″ | 171-190 | Preferred |

| 5’7″ – 5’9″ | 120-150 | Standard |

| 5’7″ – 5’9″ | 151-175 | Preferred |

| 5’7″ – 5’9″ | 176-195 | Preferred |

| 5’10” – 6’0″ | 130-160 | Standard |

Mortality Rates for Different Height and Weight Categories

This table illustrates hypothetical mortality rates for the same age group. Actual rates are far more complex and include numerous other factors like lifestyle choices, medical history, and family history. The purpose is to demonstrate how these factors are considered in calculating premiums.

| Height/Weight Category | Mortality Rate (per 10,000) |

|---|---|

| Standard | 10 |

| Preferred | 7 |

| Excellent | 4 |

Premium Determination Using the Chart

The premium category assigned in the first table is a crucial factor in determining the insurance premium. Insurance companies use complex models to arrive at premiums. These models incorporate the mortality rates and other risk factors. A ‘Standard’ category might result in a higher premium compared to a ‘Preferred’ or ‘Excellent’ category.

Hypothetical Case Study

A 32-year-old individual, 5’8″ and weighing 165 pounds, falls into the ‘Preferred’ category. This means their risk of death is lower than someone in the ‘Standard’ category, leading to a potentially lower premium. Conversely, a 32-year-old, 5’8″ individual weighing 210 pounds would likely be placed in a higher risk category and pay a higher premium.

Limitations and Biases of the Chart Examples

Height and weight charts, as simplified representations, do not account for individual health conditions, lifestyle choices, and family history. A person with a high BMI but excellent health and a family history of longevity might have a lower risk than someone with a lower BMI but a family history of premature death. This simplification inevitably introduces biases. Furthermore, these charts don’t consider factors like smoking, alcohol consumption, and exercise habits.

The charts are not a definitive measure of risk but a tool to group individuals into broad categories for pricing purposes.

Potential Impact of Technology on Charts

Life insurance premiums are influenced by factors like age, health, and lifestyle. Traditionally, height and weight charts played a role in risk assessment. However, technological advancements are rapidly reshaping this landscape, potentially leading to more precise and efficient methods for evaluating risk.The evolving world of technology presents exciting possibilities for refining how life insurance companies assess risk, moving beyond static height and weight charts.

New data sources and sophisticated algorithms offer the potential to build a more accurate picture of an individual’s health and longevity, resulting in more personalized premiums.

Emerging Technologies Enhancing Risk Assessment

Technological advancements are introducing innovative methods for risk assessment. Wearable technology, like fitness trackers and smartwatches, gathers comprehensive data on daily activity, sleep patterns, and heart rate variability. These data points can be integrated into risk models to provide a more holistic view of an individual’s health status. Furthermore, genetic testing and advanced medical imaging technologies offer insights into an individual’s predisposition to certain diseases, allowing for a more tailored risk assessment.

Incorporating New Data Sources

The incorporation of new data sources into life insurance risk assessment is a key trend. Imagine a scenario where an individual’s consistent use of health apps, meticulously tracking their dietary intake, sleep patterns, and exercise habits, is integrated into the risk assessment process. This wealth of personal health data, combined with traditional factors like height and weight, could potentially provide a more accurate picture of their health profile and longevity.

The potential exists for personalized risk assessment models to emerge, enabling a more accurate reflection of individual health risks.

Improving Efficiency and Accuracy

Technology promises to significantly enhance the efficiency and accuracy of the life insurance process. AI-powered systems can analyze vast amounts of data, identifying patterns and correlations that might be missed by human analysts. This automated process can accelerate the underwriting process, reducing turnaround times for policy applications. The accuracy of risk assessment can be improved by integrating these advanced tools, potentially leading to more precise premium calculations and a fairer assessment of risk.

Future Applications of AI in Predicting Mortality Risk

Artificial intelligence (AI) is poised to play a crucial role in predicting mortality risk. AI algorithms can be trained on vast datasets of health information, identifying complex relationships between various factors and mortality rates. For instance, an AI model could analyze an individual’s genetic makeup, lifestyle choices, and medical history to estimate their future mortality risk with greater precision.

Such predictive models could lead to more accurate premium calculations, benefitting both the insurer and the policyholder.

Illustrative Example

Consider a scenario where an individual consistently logs their health data via a wearable device. The data, encompassing activity levels, sleep quality, and heart rate, is integrated into an AI-powered risk assessment model. This data, combined with traditional factors like height, weight, and age, allows the system to generate a more nuanced risk profile for the individual. This could lead to more accurate premium calculations, reflecting the individual’s actual health status more precisely.

Final Review: Life Insurance Height Weight Chart

In conclusion, while life insurance height weight charts have been a traditional method of risk assessment, modern approaches emphasize a holistic evaluation of factors beyond just height and weight. A complete medical evaluation, lifestyle factors, and other health metrics play a significant role in contemporary risk assessment. The future of these charts likely involves a more nuanced and comprehensive approach, incorporating technological advancements to create more accurate and efficient risk evaluations.

Popular Questions

What are the limitations of using height and weight to assess mortality risk?

Height and weight charts can be inaccurate because they don’t account for individual variations in body composition, muscle mass, or underlying health conditions. They also potentially perpetuate biases based on factors like race or ethnicity.

How do insurance companies adjust premiums based on height and weight?

Insurance companies use height and weight as one factor among many in their actuarial models. Different categories are often created for height and weight ranges, with premiums increasing for those in higher-risk categories. The specific premium adjustment depends on the insurance company’s methodology.

Are there alternative methods for risk assessment in modern life insurance?

Yes, modern life insurance increasingly uses comprehensive medical evaluations, including lifestyle factors, medical history, and health metrics like blood pressure and cholesterol levels, to assess risk more accurately.

How does technology influence life insurance height weight charts?

Technology is transforming risk assessment by allowing for the analysis of vast amounts of data, including genetic information and wearable device data, to provide more personalized and accurate risk assessments. This may lead to more precise premium calculations in the future.